Medicare tax calculation 2023

CMS proposes several payment policy changes including rebasing and revising the Medicare. Your 2022 IRMAA is based on your Modified Adjusted Gross Income MAGI from 2020.

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

But are projected to become larger after 2023 due to higher projected provider payment updates.

. Prior to the switch in coverage we will be receiving the subsidy by way of a reduction in our monthly premium payment. Medicare is a government national health insurance program in the United States begun in 1965 under the Social Security Administration SSA and now administered by the Centers for Medicare and Medicaid Services CMS. Comments are due on Sept.

As we stated in the CY 2023 PFS proposed rule a draft of the updated Medicare Ground Ambulance Data Collection Instrument PDF that includes all of the CY 2023 proposed changes to review and provide comments on is posted here. Every month you delay benefits increases your checks slightly until you reach. Deduct the amount of tax paid from the tax calculation to provide an example of your 202223 tax refund.

This simplified calculation of capital gains and losses. Youll see your social security number Box A name Box E and address Box F appear here while your employers employer identification number EIN Box B name and address Box C and control number Box D if any appear here as well. August 20 2022 by Harry Sit in Healthcare.

Tax on this income. The Medicare levy surcharge is an additional tax of between 1 and 15 depending on how much you earn. The calculation of net profit versus net loss for business owners.

The amount the IRS allows as a set deduction based on the number of people in your. Social security and Medicare tax for 2022. 19c for each 1 over 18200.

Get the latest money tax and stimulus news directly in your inbox. The Centers for Medicare Medicaid Services CMS released the Calendar Year CY 2023 Medicare Physician Fee Schedule PFS Proposed Rule on July 7 2022 which impacts Medicare Part B payments starting Jan. Federal government websites often end in gov or mil.

For the purposes of this calculation this site assumes you are Single and your Rebate Income equals your Taxable Income. When she switches to Medicare we will terminate her Exchange coverage effective July 31 2023 and her Medicare coverage will start on August 1 2023. IRMAA is a pesky fee that high-earning Medicare members have to pay each month.

Begin using the forms until January 1 2023. Social Security and Medicare Boards of Trustees. The employee calculation of full-time equivalent FTE used for the PPP forgiveness report is not calculated the same way as a full.

The calculation doesnt just use the latest month over the same month a year ago. A self-employment tax feature. Calculate your total tax due using the MN tax calculator update to include the 202223 tax brackets.

In the Department of Health and Human Services HHS Notice of Benefit and Payment Parameters for 2023 Final Rule released today the Centers for Medicare Medicaid Services CMS is finalizing standards for issuers and Marketplaces as well as requirements for agents brokers web-brokers and issuers assisting consumers with enrollment through. 116th Congress Public Law 136 From the US. 2022 personal income tax rates and thresholds as published by the ATO.

The Medicare Part B 2022 standard monthly premium is 17010. 2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets. 202223 Minnesota State Tax Refund Calculator.

Additional Medicare Tax applies to Medicare wages Railroad Retirement Tax Act compen-sation and self-employment income over 200000 if you are filing as single head of. These changes if finalized would be effective on or after January 1 2023. Also calculates your low income tax offset HELP SAPTO and medicare levy.

Click Calculate to see your tax medicare and take home breakdown - Federal Tax made Simple. 202223 Ohio State Tax Refund Calculator. How to read the EITC tables.

The maximum earned income credit allowedpayable for the given tax year is shown in line 1. Click Calculate to see your tax medicare and take home breakdown - Federal Tax made Simple. 281 Public Law 116-136 116th Congress An Act To amend the Internal Revenue Code of 1986 to repeal the excise tax on high cost employer-sponsored health coverage.

Automatic calculation of taxable social security benefits. Deduct the amount of tax paid from the tax calculation to provide an example of your 202223 tax refund. For the 75-year projection period the HI actuarial deficit has decreased to 070 percent of payroll from 077 percent in last years report and is equivalent to 03 percent of GDP through 2096.

The low income earner exemption thresholds were also raised. To start claiming this credit you must have at least 1 of earned income with line 2 showing the minimum amount of earned income required to get the maximum earned. The full 15 is only applied to singles who earn more than 140k a year or couples.

It primarily provides health insurance for Americans aged 65 and older but also for some younger people with disability status as determined by. Business Tax Deduction. Business owners must include their business earnings when they file their tax returns.

The cap on wages for the Medicare tax was removed by The Omnibus Budget Reconciliation Act of 1993 or OBRA-93. CMS officials say that reflecting the savings in what Medicare will likely have to spend on those beneficiaries who will be eligible for Aduhelm in the calculation of the 2023 Medicare Part B premium is the most effective way to deliver these savings back to people with Medicare Part B CMS is expected to announce the 2023 Part B premium in the fall. Calculate your total tax due using the OH tax calculator update to include the 202223 tax brackets.

The Medicare levy was raised again by the Keating Labor Government in July 1993 up to 14 of income again to fund additional healthcare spending outlays. In August of 2023 my wife will turn 65 and be eligible for Medicare. Marketplace Stakeholder Technical Assistance Tip Sheet on the Monthly Special Enrollment Period for Advance Payments of the Premium Tax Credit Eligible Consumers with Household Income at or below 150 of the Federal Poverty Level PDF April 28 2022 Final 2023 Letter to Issuers in the Federally-facilitated Exchanges PDF July 18 2022.

It also includes. Government Publishing Office Page 134 STAT. Low income tax offset from 2022 to 2023 18200 37000 700.

Updated 2022 IRMAA brackets can increase Medicare Part B monthly premiums by as much as 40820 and. These boxes on the W-2 provide all the identifying information related to you and your employer. The American Rescue Plan Act stipulates that the nonrefundable pieces of the employee retention tax credit will be claimed against Medicare taxes instead of against Social Security taxes as they were in 2020.

The 78k salary example is great for employees who have standard payroll deductions and for a quick snapshot of the take home amount when browsing new job opportunities in Australia for those who want to compare salaries have non-standard payroll deductions of simply wish to produce a bespoke. Before sharing sensitive information make sure youre on a federal government site. Tax Rates 2022-2023.

If you begin claiming at 62 youll get only 70 of your standard benefit if your FRA is 67 or 75 if your FRA is 66. Therefore the payer of your periodic pension or annuity payments or nonperiodic payments and. When you file your 2022 federal income tax return in 2023 attach Schedule H Form 1040 to your Form 1040 1040-SR 1040-NR 1040-SS or 1041.

The gov means its official.

What Is The Maximum Taxable Income For Social Security For 2023 Gobankingrates

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

Medicare Part B Premiums For 2022 Jump By 14 5 From This Year Far Above The Estimated Rise In Cost Medicare Tax Brackets Required Minimum Distribution

Calendar Year 2023 Medicare Physician Fee Schedule Proposed Rule Part 2 Youtube

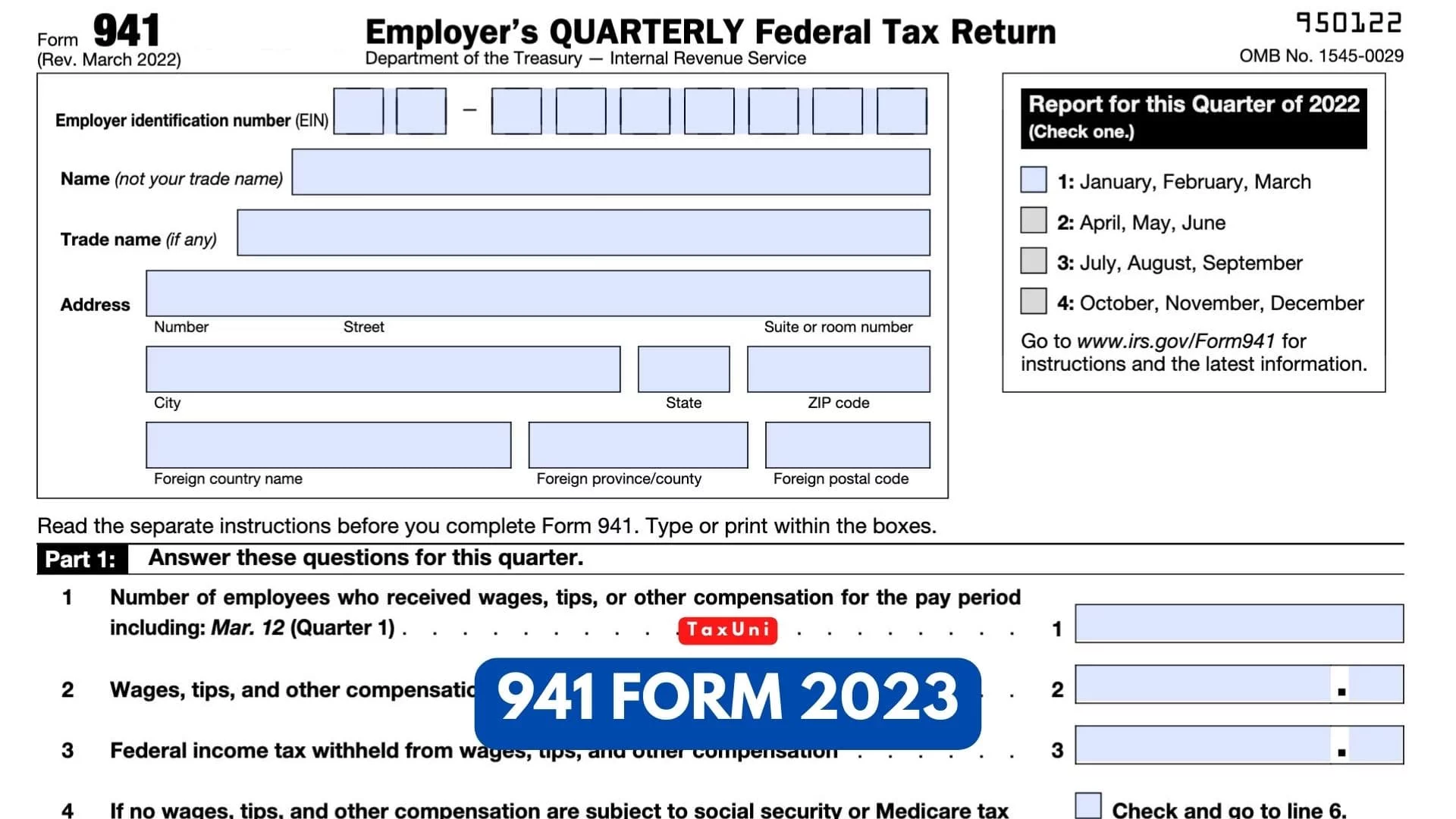

Form 941 For 2023

Moaa Here S Why Your Medicare Part B Costs May Drop In 2023

You Won T Believe The Size Of This 2023 Social Security Cola Estimate 401 K Specialist

Social Security What Is The Wage Base For 2023 Gobankingrates

2023 Health Savings Accounts Limits Are Released By The Irs Calcpa Health Trusted Health Plans For Cpas

941 Form 2023

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

Medicare Rbrvs 2023 The Physicians Guide 9781640162310 Medicine Health Science Books Amazon Com

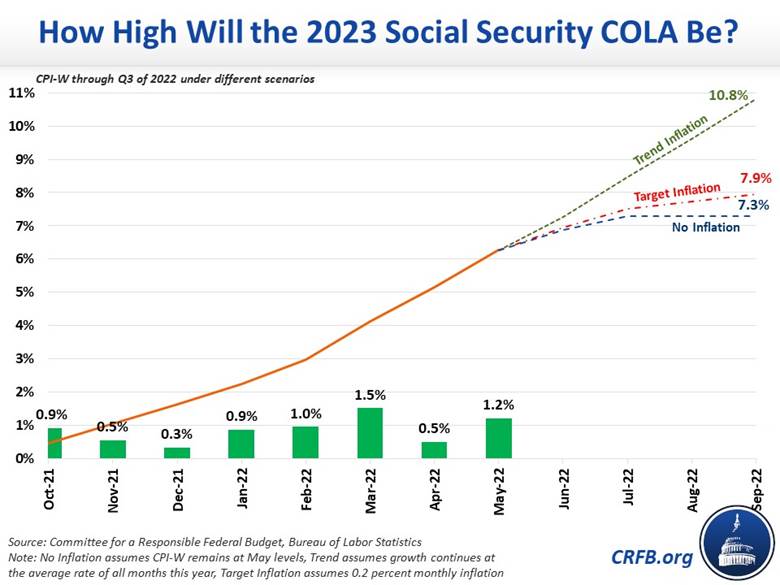

Could 2023 Social Security Cola Hit 9 Benefitspro

Yes Social Security S Cost Of Living Adjustment For 2023 Is Expected To Be Higher Than Average Youtube

Early Social Security Ssi Cola Predictions For 2023 Youtube

Medicare And Taxes How Your 2023 Medicare Premiums Are Affected By Your 2021 Tax Filing Gobankingrates

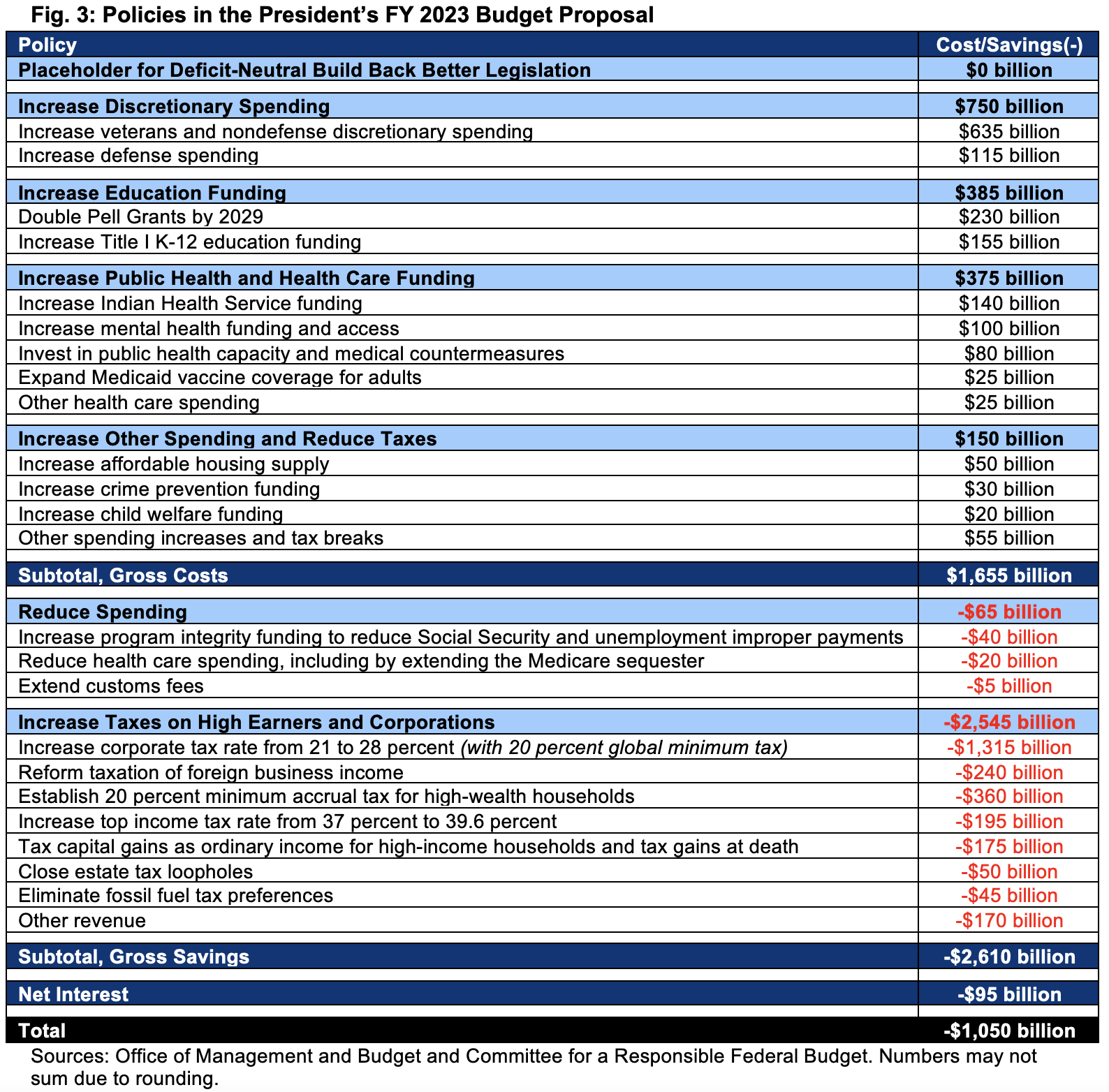

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget